If you want to save smart, here are seven apps to help you manage your money from your phone

Beanstalk

If you are looking to invest on behalf of a child, the Beanstalk app will grow your initial investment in a junior stocks and shares ISA until they reach adulthood. Giving all family members access means grandparents, godparents and other family members can contribute too – whether they are saving for their first car, uni or another milestone. Download it.

Plum

Plum is one of the most comprehensive money saving apps on the market, offering simple easy access ‘Pockets’ to save money into that’s ring fenced from your day-to-day spending and private pension pots as well as stocks and shares ISAs. Plum can round up each purchase for you and save the difference or make automatic lump sum savings on payday into all or some of their saving options above. They can also alert you when they identify you’re overpaying on bills and offer cash back deals with partner retailers, too. Download it.

Snoop

If you are a bargain hunter, Snoop is a great app that reviews your regular shopping haunts and shares discount codes with you to save on your next purchase. It will also share better deals across energy, mobile and broadband, prompting you when your contract is up for renewal and sharing the best deals around to save you time on comparison sites. Download it.

Go Henry

Teaching your children financial literacy is vital if they are to get to grips with their own spending/saving. Go Henry offers a prepaid debit card, with a financial education app to help get them off to a good start. Kids get to set their own savings goals, whilst parents get to see what they’re spending, with live updates in their companion app and the ability to set them tasks to allow them to earn more cash. A great first step to financial independence. Download it.

Raisin

Where you save your money matters. However, if you don’t have time to trawl the internet to find the best interest rate for your nest egg, Raisin allows you to sign up, free of charge, to their interest-rate marketplace and browse all the best deals. They’ll help you move your cash, with a sign-up bonus, too. Download it.

Cleo

Another great budgeting app, Cleo will create budgets for all areas of your life (going out, food, house deposit etc) and identify from your spending habits, what you can afford to save each month. A great visual tracker to stay connected to your real-time finances. Download it.

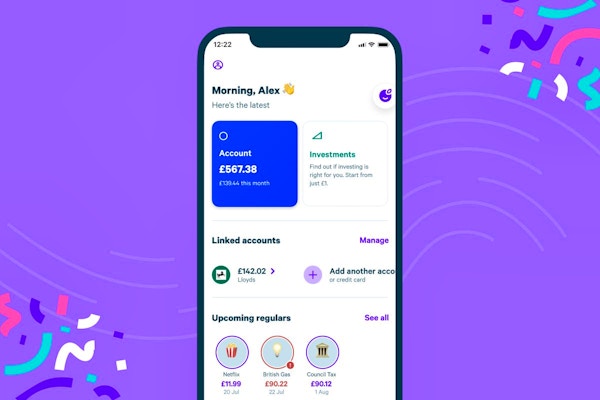

Emma

Emma is a really clever financial analyst in your pocket. It connects all your accounts in one place, plus not only can AI bot Emma tell you your predicted spending for the month ahead, but she can help you categorise and budget so you can see where you are going over. She’ll also analyse your reoccurring payments to find any wasteful subscriptions, giving you a dashboard of all your monthly outgoings. Download it.

5 Tips To Get To Grips With Your Finances

Follow The 50: 30: 20 Rule

When it comes to divvying up your gross income, breaking it down as follows is a simple rule to use: 50% needs, 30% wants, 20% saving. Of course, it is flexible, but it is a good benchmark to ensure all areas are covered. Needs would be fixed costs, such as mortgage/rent, insurances, loans. Wants include holidays, clothes and meals out. Savings are your investments for the future.Know Where Your Money Is Going

It may seem simple, but do you scrutinise and itemise your bank statement each month to see where your money is being spent. Even a quick read through might highlight to you just how much you are spending on food delivery apps, or clothes. Seeing it in black and white and totalling up each area will help you understand your spending patterns.Pay Off Your Debts

You may have good intentions to start saving, but do prioritise your debts first. If you are paying interest then by reducing them you will be spending to save. Yet if you pay them off sooner you will save on future interest payments, allowing you to invest instead.

Set Personal Goals That Feel Achievable

The idea of saving can feel daunting, especially if you are finding it hard to make ends meet as it is. But having personal goals that motivate you will encourage you to look at your finances and perhaps make savings in some areas, so you can, well, make savings. A great way to save without thinking about it is through ‘round-ups’. Many apps offer the ability to round up each purchase you make to the nearest £1 and save the difference, it might be pence, but it will all be saved away and add up incrementally.Keep On Top Of Subscriptions And Rolling Contracts

It may feel like now is not the time to find a deal, but re-evaluating your subscriptions, gym memberships, phone contracts and insurances periodically will ensure you are getting the best possible rate. Think about downgrading your plans, or perhaps not upgrading your phone as a force of habit every 12 months and thereby reduce your monthly costs.By Lydia Mansi

October 2022